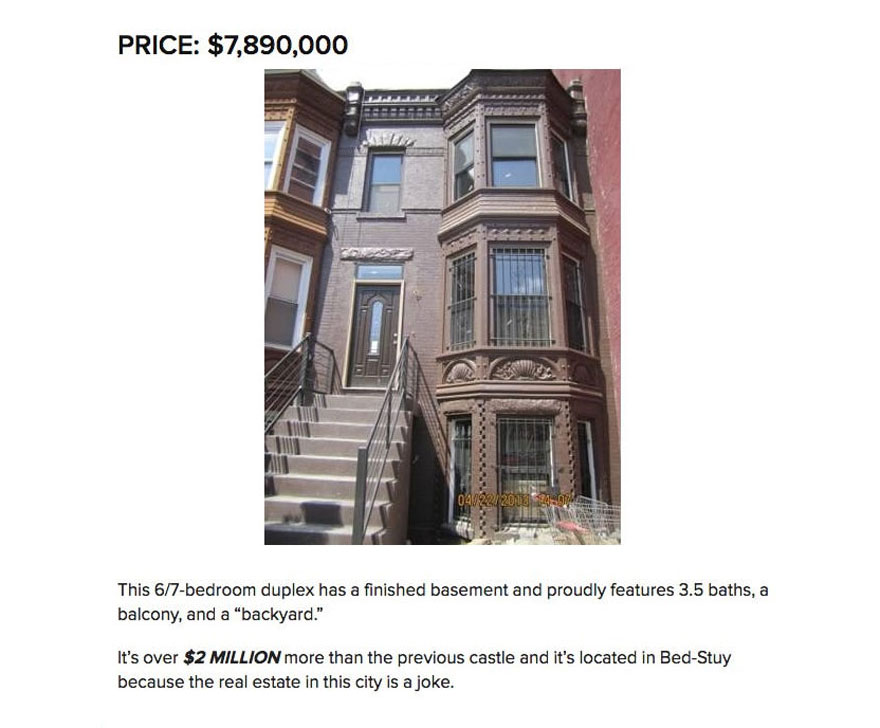

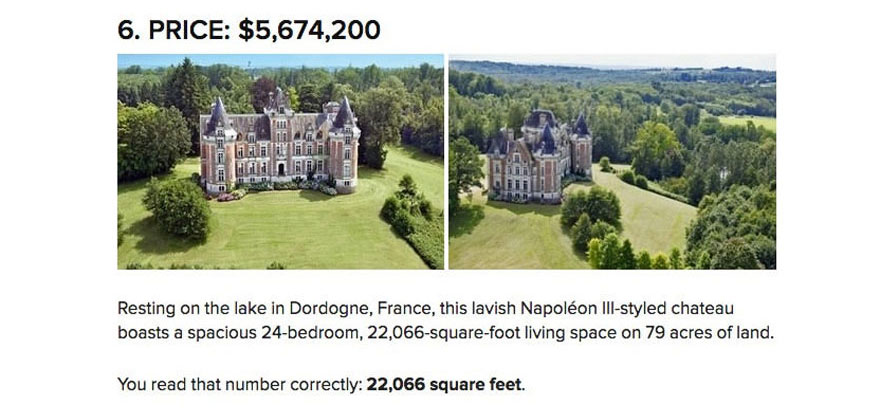

This series of pictures of castles and NYC apartments has been trending on the internet.

Everyone recognizes that real estate in NYC is outrageously expensive. What they fail to recognize is that it’s the city’s rent control and zoning policies since WWII that have prevented the construction necessary to meet New York citizens’ housing needs.

The irony is that some of the policies most responsible for New York’s outrageously high real estate prices are precisely the policies meant to alleviate the problems of high prices. It reminds me of Mises’ observations on the decline of the Roman Empire. In Rome, strict price ceilings held down the prices of grain and wine, and made it impossible to profit by growing these necessities. In NYC, the same goes for housing. Is there any doubt that, if one could simply buy a plot of land and build on it without government interference, building a tall building and selling every unit for $2,000,000 would be a profitable venture? New construction would quickly reduce prices in a free market. That’s not to say a Manhattan apartment would be as cheap as one in Houston; Manhattan is an island and many people want to live there. However, housing there would be a lot cheaper if restrictions were few.

Regulations are most dangerous when they provide short-term relief from the problems they cause. Societies that fail to recognize the long-term consequences of these policies are like alcoholics who drink to solve their problems.

The post NYC Apartments Cost as Much as Castles (and People Just Don’t Get Why) appeared first on The Economics Detective.