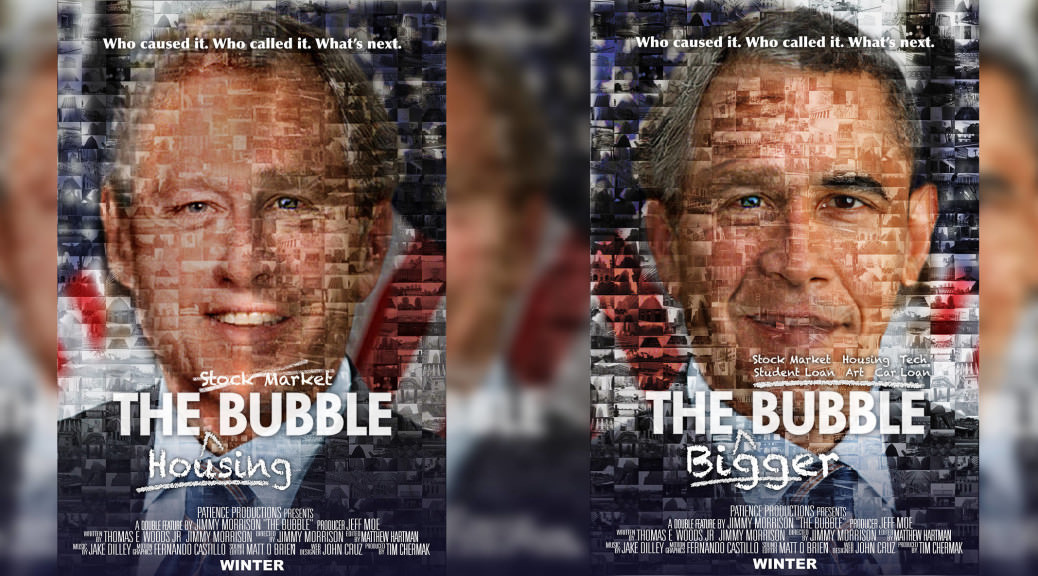

Jimmy Morrison is an independent filmmaker who is currently directing two films: The Housing Bubble and The Bigger Bubble. The Housing Bubble deals with the history of business cycles in America, spanning from the First World War to the 2008 crash. The Bigger Bubble deals with the aftermath of the 2008 crash. These films began as a single project, but Jimmy chose to split it into two films in order to tell the full story.

The films’ website provides a synopsis:

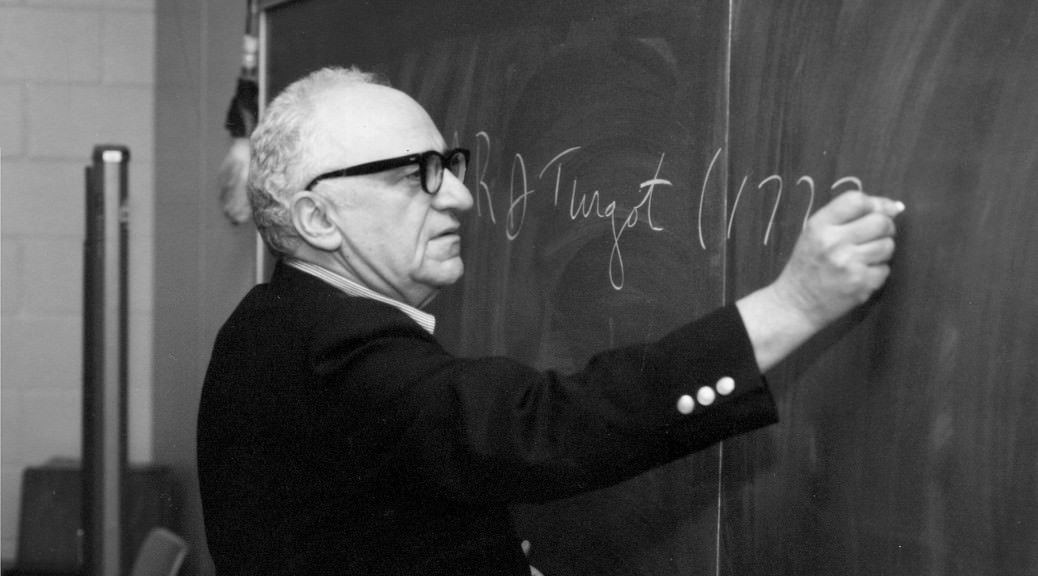

The Bubble is coming out at a crucial time in American history. Numerous films have blamed the free market for the economic woes of the country. Uniquely, Tom Woods has teamed up with experts such as Ron Paul, Peter Schiff, Jim Rogers, Marc Faber and Doug Casey to explain the economic problems America is facing and what is needed to restore prosperity.

You can’t watch the news today without hearing more calls for regulation. Deregulation is consistently the boogey man when it comes to sound bite explanations of this economic crisis. The public currently believes the government saved us during the Great Depression and that it will save us again today. America needs a simple economics lesson on this recession and Tom Woods has done just that in his book Meltdown. The Bubble successfully adapts Meltdown into a feature-length documentary.

The Bubble features interviews with numerous economists and financial analysts who actually predicted the housing crisis and recession. The people we are trusting to solve this problem claim no one saw it coming. The fact is Austrian economists predicted this recession years ago, and they are the only ones with the insight necessary to bring us out of this economic slide. This film asks them why this crisis happened, how we recover, and what America is facing.

Subscribe to Economics Detective Radio on iTunes or Stitcher.

The post The Bubble Films with Jimmy Morrison appeared first on The Economics Detective.