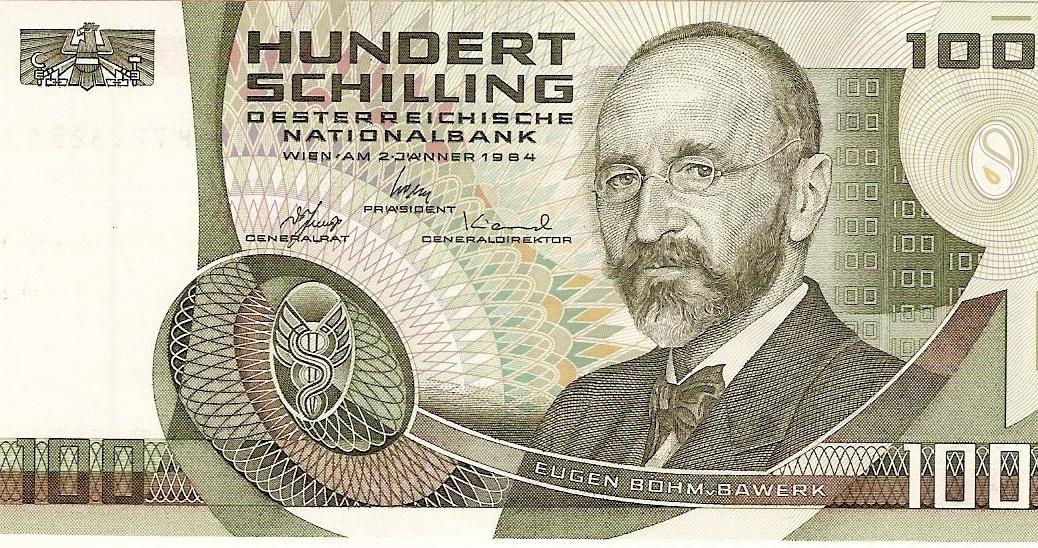

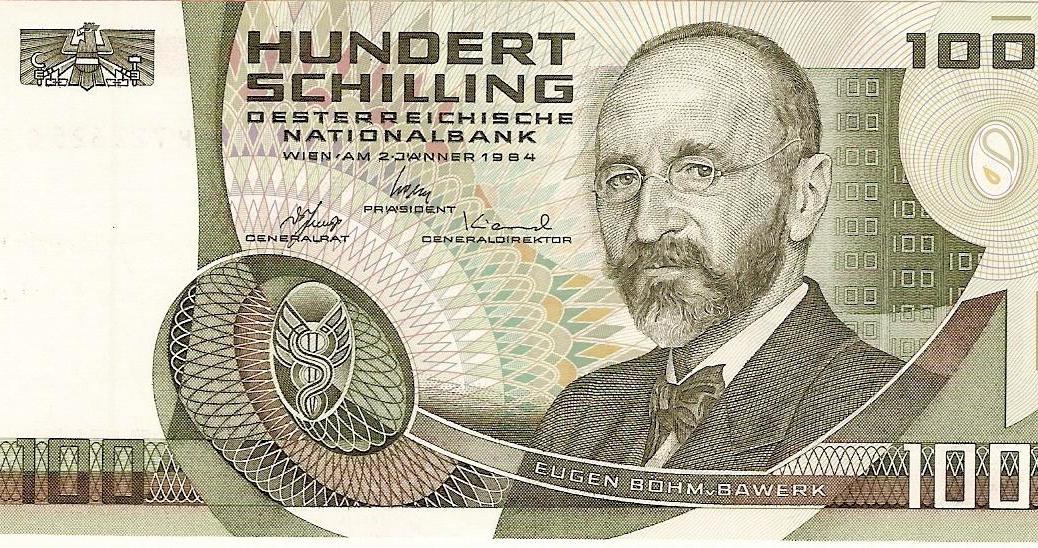

I have published my first blog post over at Mises Canada. The post relates Böhm-Bawerk’s price theory to modern job-matching models. Here are the key paragraphs:

[M]odern labour economists’ use of discrete reasoning in job-matching models should be lauded as a step towards greater realism. In these models, there are a discrete number of unemployed workers seeking to fill a discrete number of job openings. These models are summarized by Alvaredo, Atkinson, Piketty, and Saez:

“[I]n the now-standard models of job-matching, a job emerges as the result of the costly creation of a vacancy by the employer and of job search by the employee. A match creates a positive surplus, and there is Nash bargaining over the division of the surplus, leading to a proportion β going to the worker and (1 – β) to the employer.”[4]

In these models, as in the real world, workers and employers must find each other before they can engage in exchange. Often, the model is set up such that only one worker and one employer find each other at a given time, making their exchange a case of isolated exchange. If multiple workers or employers discover each other at the same time, then Böhm-Bawerk’s analysis of one- or two-sided competition applies. Both workers and employers form their valuations based on their expectations of the other opportunities they might find if they engage in further search.

However, while Böhm-Bawerk and his heirs in the Austrian school are satisfied to leave the determination of price unspecified within the range bounded by the marginal pairs, modern economists feel the need to uniquely determine prices within their models, thus the addition of Nash bargaining and the nebulous “β” term, the “bargaining power” of the worker. β must be precisely specified and known so that the homines economici in search models can form their valuations based on perfect knowledge of the random processes determining the future outcomes of search and of their exact payoffs under all possible matchings. If economists were to admit that the division of surplus is inherently idiosyncratic and unpredictable, their models would break.

Furthermore, simply by referring to “bargaining power,” economists imply more than their models can support. Suppose that the marginal pairs determined that the price of a given item should fall between $396 and $412. If the actual price attained is $400, should we conclude that buyers’ “bargaining power” is four times that of sellers, or that they settled on $400 simply because it is a round number acceptable to both buyers and sellers? One cannot know.

Read the whole thing.

The post Mainstream Economists Rediscover the Marginal Pair appeared first on The Economics Detective.