As a Canadian, it’s very strange hearing Americans talk about the Great Depression. The American public education system apparently has a monolithic view on the subject. Based purely on my interactions with people who have passed through that system, I imagine their kindergarten classes must be something like this:

TEACHER: Alright students, what’s 1 + 1?

STUDENTS: 2!

TEACHER: What’s 2 + 2?

STUDENTS: 4!

TEACHER: What do you call someone who doubts the efficacy of FDR’s policies in bringing an end to the Great Depression?

STUDENTS: Insane!

The Great Depression is a complex historical event, so the level of confidence I see from American laymen certainly makes it seem like they’ve been brainwashed from a young age. Maybe it’s just the sort of Americans who make internet comments.

If you believe that it is clearly and obviously true that (1) the New Deal ended the Great Depression or that (2) World War 2 ended the Great Depression, this article is for you. I’m not going to make a slam-dunk case against these notions; if you’re looking for one, you’ll need to read something far longer than a blog post. I recommend Robert Higgs or Bob Murphy. My goal here is to make the case that these ideas, far from being obvious, are actually very counter intuitive given the facts.

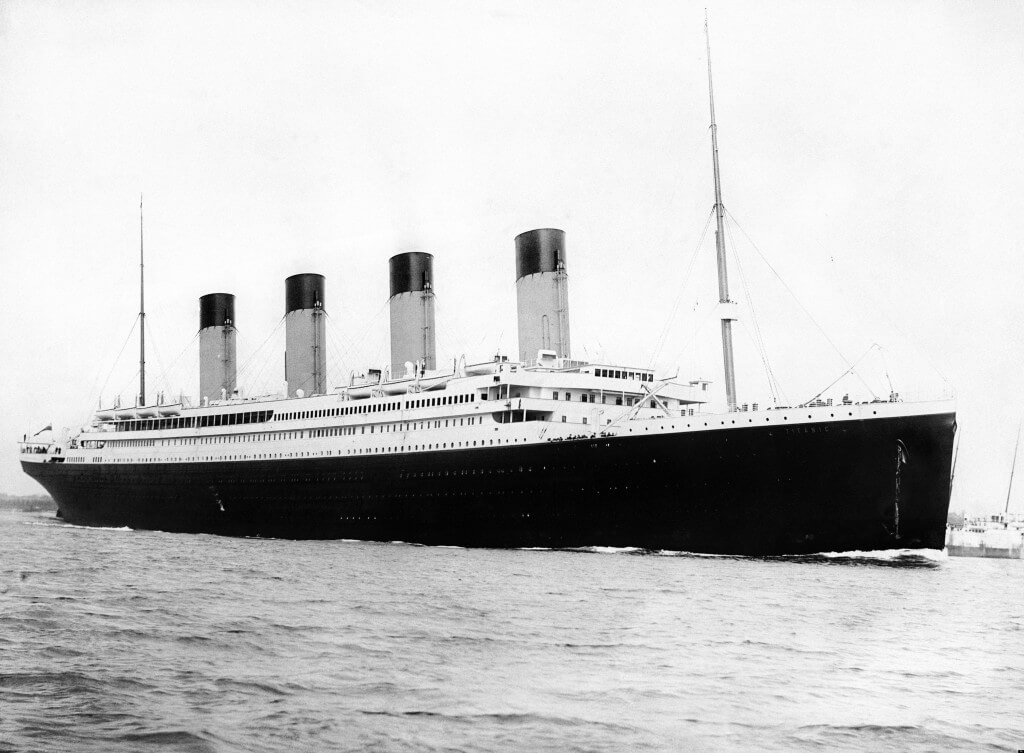

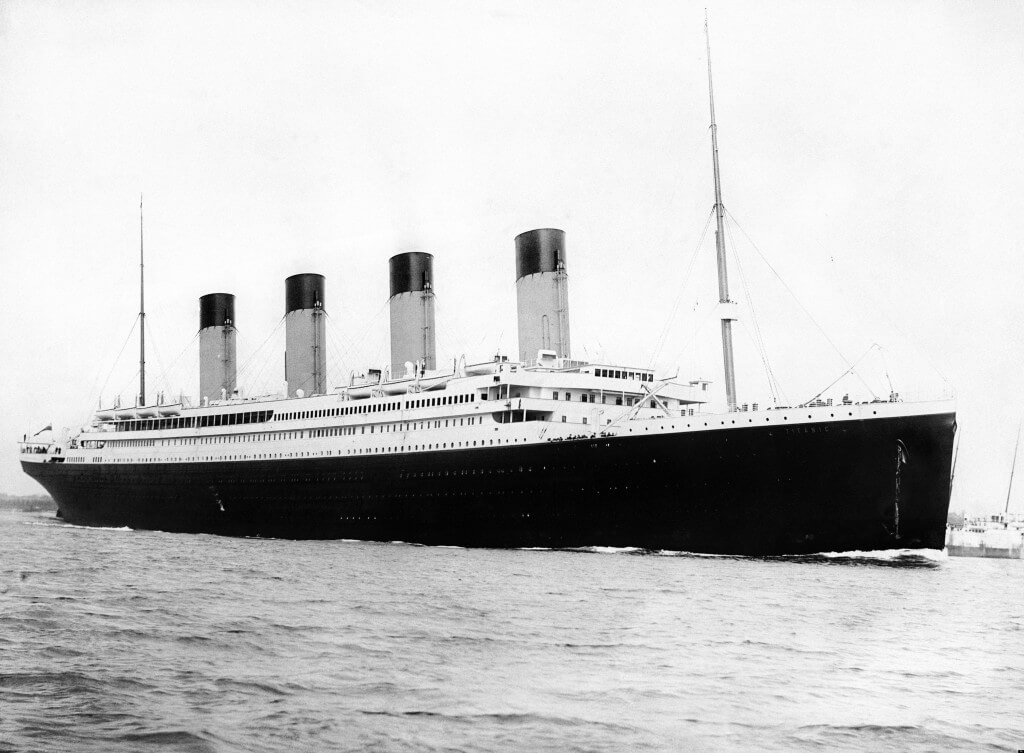

The Great Depression is to Economic History as the Titanic is to Nautical History

I made an offhand comment in my conversation with Jimmy Morrison comparing the idea that Hoover and FDR’s interventionist policies are the ideal response to a depression to the idea that the Titanic represents the ideal response to an iceberg. My point was that when something is remembered as the single most disastrous event of its kind, there are probably a bunch of things that went wrong.

I made an offhand comment in my conversation with Jimmy Morrison comparing the idea that Hoover and FDR’s interventionist policies are the ideal response to a depression to the idea that the Titanic represents the ideal response to an iceberg. My point was that when something is remembered as the single most disastrous event of its kind, there are probably a bunch of things that went wrong.

Sure, it could be the case that the captain and crew of the Titanic did everything right, and that it would have been an even bigger disaster if they had pursued any other policy. But then wouldn’t there be a whole lot of much bigger nautical disasters where the crews’ responses weren’t so perfect?

Similarly, it could be the case that FDR’s response to the Great Depression was the best possible response and it would have been much worse otherwise. But then wouldn’t there have been a whole lot of much bigger economic disasters where the responses weren’t so amazing?

There were a lot of recessions (called “panics”) before 1929. None of them turned out as badly as the Great Depression. None of them had a New Deal or a world war to bring them to an end. Isn’t it plausible that the policy responses to those recessions were better than the policy response to the Great Depression?

The Great Depression Lasted Longer than You Think

Here’s some data from the St. Louis Fed on the Great Depression. The blue line is GDP, and it sure seems to support the idea that WWII was great for the American economy. Look how it shoots up during the war years! Unemployment, the yellow and orange lines (there are two of them because they changed the way they calculated unemployment midway through this period), was pretty dismal for the entire decade of the 1930s, but it came right back down as people were drafted en masse into military service and employed in military industries.

The line I want you to focus on is the red line: real personal consumption expenditures. This is a better indicator of how the average person was living than GDP. The increase in GDP during WWII was just an increase in the amount the government spent making bombs and dropping them on people. The amount the average person had to spend actually dipped during the war years. 1946 was a far nicer time to live than 1944, even if GDP was lower.

Even consumption expenditures understate how not nice 1944 was. With the wartime price controls and rationing, there were things you simply couldn’t buy even if you had money to spend. Today, in 2015, if I have $20 to spend, I’ll spend the first dollar on the thing I value most, the second dollar on the thing I value second most, etc. In 1944, if the things I value most are an egg, an egg, and another egg, but my egg ration only allows me to buy one, I have to move on to buying things I value less than eggs. So the dip in consumption expenditure actually understates how the average person’s ability to fulfill his wants would have declined because of the war.

All this is to say that there wasn’t a return to prosperity until after WWII; the Great Depression really lasted from 1929 to 1946. If the New Deal or WWII ended the Great Depression, they would have had to do so on a delayed fuse (a very long one in the case of the New Deal). I can’t see a plausible reason to believe that.

Absurd Counterfactuals are Absurd

The very question, “What ended the Great Depression?” (which I guess is a common exam question) assumes an absurd counterfactual: that the Great Depression would have gone on indefinitely if something big hadn’t come along to end it.

In reality, the economy has the property statisticians call “mean reversion.” That means that when some big, crazy thing happens to push it off its growth path (a “shock,” in econ jargon), things eventually settle down and go back to normal; the economy reverts to its equilibrium growth path. As I mentioned above, there were lots of recessions (or “panics”) before 1929, and they were all resolved far faster than the Great Depression.

One very naïve brand of praise for Roosevelt looks at the growth in GDP from the time he took office in 1933, at the economy’s nadir, to the time he died in 1945, when WWII spending was near its height. Aside from GDP being a poor measure of the health of the economy when price controls and a World War are mucking things up, what level of growth should we have expected during FDR’s presidency?

The answer, given the mean-reverting tendency of economic growth, is that we should have expected higher-than-average growth. Anyone who compares growth under Roosevelt to a baseline of no growth or average growth is ignoring that the economy was at the bottom of a dip, that the unemployment rate was up near a quarter, and that we would expect the economy to grow very quickly as those people entered the labour force. Of course, unemployment stayed consistently high until the buildup to WWII.

Conclusion

If you believed before that either the New Deal or WWII ended the Great Depression, I hope I’ve at least created some doubt in your mind. People who say that the New Deal and WWII were actually bad for the American economy are not saying that 1+1=3 or that the universe is 6,000 years old.

In fact, the prima facie evidence is firmly on their side. The Great Depression was a long, drawn-out catastrophe. Is it so unreasonable to say that whatever they were doing during the Great Depression, we should try to do the opposite? The case is doubly bolstered when you realize that the interventionist policies that became the New Deal didn’t start in 1933 with FDR’s election; they started under the allegedly laissez faire Herbert Hoover.

It’s very convenient for the political class that such a counterintuitive idea would achieve such a sweeping consensus among the general population. Of course, we can never know if that wasn’t precisely the agenda of the people who wrote and selected the history texts that would become standard in the educations of generations of American students.

I hope that in addition to causing you to doubt this particular view of the Great Depression, I’ve disabused you of the more general idea that there are clear-cut “lessons of history.” Sometimes, the lesson you think you’re getting from history is really just the bias held by the people who wrote the history books.

The post The Prima Facie Case that Great Depression Policy was Really Really Bad appeared first on The Economics Detective.

I made an offhand comment in

I made an offhand comment in